Tax season is upon us, so we’d like to offer a few federal income tax reimbursement reminders and tips for medical cannabis patients.

Even if you don’t have insurance coverage via a healthcare spending plan or a licensed producer (LP) compassionate pricing discount, claiming expenses on your annual income tax return can help make your medication more affordable.

Who is eligible to claim medical cannabis on their tax return?

Anyone who has a valid authorization to purchase medical cannabis from a licensed producer in Canada. Therefore, if you are an active Harvest Medicine patient in good standing, you are most likely able to do so. Please note that reimbursement may depend on your total income and spending amounts.

You cannot make a claim using receipts from recreational store purchases or dispensaries.

What medical cannabis expenses can I claim?

-

Any medical cannabis product purchased from a Canadian LP, including dried flower, pre-rolls, oils, topicals, vapes, or capsules, concentrates and edibles. The CRA also outlines on their website which cannabis product formats are eligible to be claimed.

-

Patients with a valid authorization for a vaporizer device may claim the amount incurred under “medical devices”

Items that may not be claimed: paraphernalia, cleaning supplies, growing supplies, clothing, or swag.

How to claim your medical cannabis on your return?

It’s as easy as tallying up your yearly spend and plugging it into the correct box!

-

Expenses can be claimed on line 33099 or line 33199 under Step 5 – Federal Tax

-

You will be asked to submit a total of expenses; simply refer to the invoices that have been shipped with each order for amounts

-

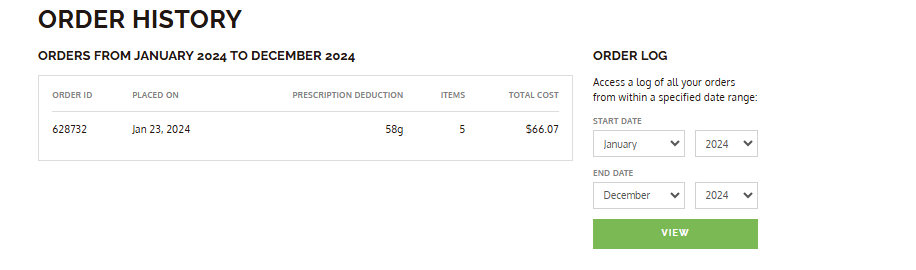

If you don’t have your receipts handy, they can usually be accessed from your online LP account

-

Note that if you have multiple LP’s you will need to access each account individually